The Basic Principles Of Feie Calculator

Table of ContentsHow Feie Calculator can Save You Time, Stress, and Money.Feie Calculator Can Be Fun For EveryoneFeie Calculator Fundamentals ExplainedThe Facts About Feie Calculator UncoveredThe Main Principles Of Feie Calculator Getting The Feie Calculator To WorkGet This Report about Feie Calculator

If he 'd often taken a trip, he would rather complete Part III, providing the 12-month duration he met the Physical Existence Examination and his travel background - Physical Presence Test for FEIE. Action 3: Coverage Foreign Income (Component IV): Mark earned 4,500 each month (54,000 each year). He enters this under "Foreign Earned Income." If his employer-provided housing, its worth is additionally included.Mark determines the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Because he lived in Germany all year, the portion of time he resided abroad throughout the tax is 100% and he enters $59,400 as his FEIE. Mark reports complete salaries on his Kind 1040 and gets in the FEIE as an unfavorable amount on Schedule 1, Line 8d, lowering his taxable income.

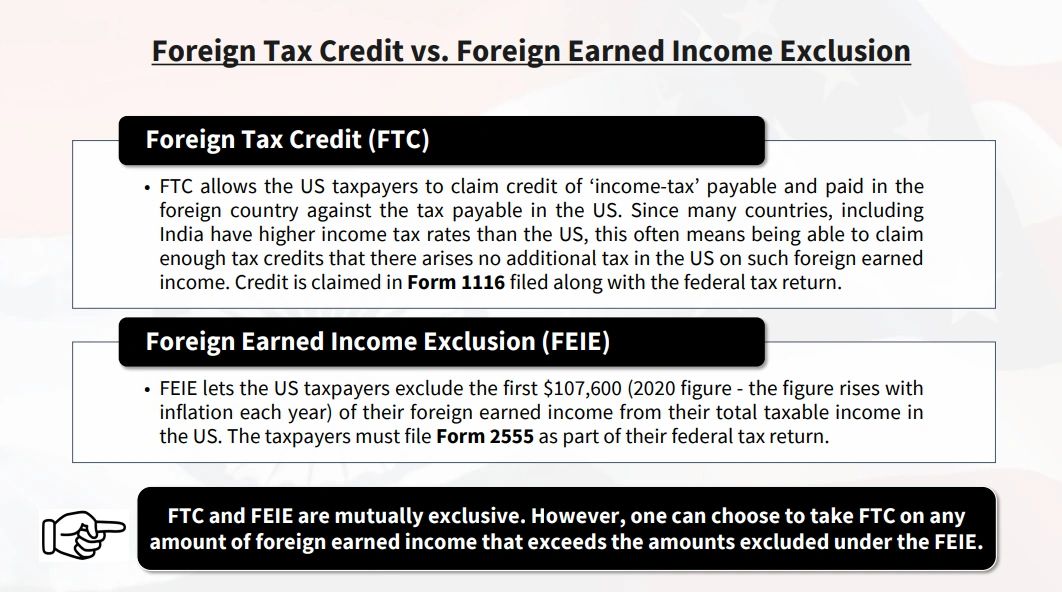

Picking the FEIE when it's not the best option: The FEIE may not be optimal if you have a high unearned earnings, make greater than the exemption limit, or stay in a high-tax nation where the Foreign Tax Credit History (FTC) may be much more beneficial. The Foreign Tax Credit (FTC) is a tax decrease technique commonly utilized combined with the FEIE.

The Main Principles Of Feie Calculator

deportees to offset their U.S. tax financial obligation with foreign revenue taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax countries, the FTC can often get rid of united state tax financial debt entirely. Nonetheless, the FTC has limitations on qualified taxes and the optimum case quantity: Qualified tax obligations: Only revenue taxes (or tax obligations in lieu of earnings tax obligations) paid to foreign federal governments are qualified.

tax obligation responsibility on your foreign income. If the foreign taxes you paid exceed this limitation, the excess foreign tax can usually be continued for up to 10 years or lugged back one year (using a modified return). Preserving exact records of international income and taxes paid is as a result crucial to computing the appropriate FTC and keeping tax obligation compliance.

migrants to lower their tax obligation responsibilities. For example, if an U.S. taxpayer has $250,000 in foreign-earned income, they can leave out as much as $130,000 making use of the FEIE (2025 ). The remaining $120,000 may then go through taxation, yet the U.S. taxpayer can potentially apply the Foreign Tax obligation Credit rating to balance out the taxes paid to the foreign nation.

See This Report on Feie Calculator

He marketed his United state home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his better half to help accomplish the Bona Fide Residency Test. Neil aims out that acquiring property abroad can be challenging without very first experiencing the area.

"We'll absolutely be outside of that. Also if we return to the US for doctor's visits or company phone calls, I question we'll invest greater than one month in the United States in any given 12-month duration." Neil emphasizes the significance of strict monitoring of united state gos to. "It's something that people need to be really diligent about," he claims, and suggests expats to be mindful of common errors, such as overstaying in the united state

Neil takes care to stress to united state tax obligation authorities that "I'm not conducting any type of company in Illinois. It's just a mailing address." Lewis Chessis is a tax obligation expert on the Harness system with extensive experience assisting U.S. residents browse the often-confusing realm of global tax compliance. One of one of the most usual mistaken beliefs among U.S.

Get This Report on Feie Calculator

tax obligation return. "The Foreign Tax Credit report enables individuals operating in high-tax countries like the UK to offset their U.S. tax liability by the amount they have actually already paid in taxes abroad," says Lewis. This guarantees that expats are not exhausted twice on the very same earnings. However, those in reduced- or no-tax nations, such as the UAE or Singapore, face extra difficulties.

The prospect of reduced living expenses can be alluring, however it typically features trade-offs that aren't quickly evident - https://justpaste.it/2891m. Housing, for example, can be extra budget-friendly in some nations, but this can indicate compromising on framework, Read Full Report safety and security, or accessibility to reputable energies and services. Economical residential properties could be situated in locations with irregular web, limited mass transit, or unstable medical care facilitiesfactors that can significantly affect your day-to-day life

Below are a few of one of the most regularly asked inquiries concerning the FEIE and various other exemptions The International Earned Income Exemption (FEIE) enables united state taxpayers to leave out approximately $130,000 of foreign-earned earnings from federal revenue tax obligation, decreasing their united state tax obligation obligation. To receive FEIE, you must meet either the Physical Presence Test (330 days abroad) or the Authentic Home Test (show your primary home in an international nation for a whole tax year).

The Physical Visibility Test needs you to be outside the united state for 330 days within a 12-month period. The Physical Visibility Test likewise needs U.S. taxpayers to have both an international revenue and a foreign tax home. A tax obligation home is defined as your prime location for business or work, despite your family's house. https://www.bunity.com/feie-calculator.

The smart Trick of Feie Calculator That Nobody is Talking About

A revenue tax obligation treaty between the united state and another nation can aid prevent double taxes. While the Foreign Earned Income Exemption lowers taxable income, a treaty may give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for declare U.S. people with over $10,000 in foreign monetary accounts.

Neil Johnson, CPA, is a tax obligation advisor on the Harness platform and the owner of The Tax obligation Dude. He has over thirty years of experience and now specializes in CFO services, equity compensation, copyright taxation, marijuana taxes and separation associated tax/financial planning matters. He is an expat based in Mexico.

The foreign earned income exemptions, sometimes referred to as the Sec. 911 exemptions, leave out tax obligation on earnings earned from working abroad.

See This Report on Feie Calculator

The revenue exemption is now indexed for inflation. The optimal annual income exemption is $130,000 for 2025. The tax benefit omits the income from tax obligation at bottom tax obligation prices. Previously, the exclusions "came off the top" lowering earnings topic to tax at the leading tax obligation prices. The exemptions may or might not decrease income used for various other objectives, such as IRA limits, kid credits, individual exemptions, etc.

These exclusions do not excuse the incomes from United States taxation but merely offer a tax reduction. Keep in mind that a solitary individual functioning abroad for all of 2025 that made concerning $145,000 without any various other earnings will certainly have gross income reduced to no - successfully the exact same response as being "free of tax." The exemptions are calculated every day.

If you attended business meetings or seminars in the United States while living abroad, revenue for those days can not be left out. Your wages can be paid in the US or abroad. Your company's area or the place where wages are paid are not aspects in certifying for the exclusions. Form 2555. No. For United States tax obligation it does not matter where you keep your funds - you are taxed on your worldwide earnings as an US individual.